Introduction

In today’s competitive market, building strong business credit is not just a luxury—it’s a necessity. Whether you’re launching a startup or scaling an existing business, access to funding, favorable loan terms, and vendor trust all rely heavily on your business credit profile. That’s where Coyyn.com steps in as a powerful ally.

As a trusted platform in the financial services space, Coyyn.com has emerged as a key player in helping entrepreneurs and small businesses build, improve, and manage their business credit effectively in 2025. But how exactly does Coyyn.com help with business credit building? Let’s break it down.

What is Business Credit and Why Does It Matter?

Before diving into Coyyn.com’s offerings, it’s essential to understand what business credit is.

Business credit means your business can borrow funds or buy goods/services on credit based on its financial credibility. Business credit is associated with your company’s Employer Identification Number (EIN) instead of your Social Security Number, unlike personal credit.

Top Reasons Business Credit Is Important:

- Secures business loans and lines of credit

- Establishes trust with suppliers, vendors, and partners

- Splits personal and business expenses

- Liberates improved terms of financing and higher credit limits

In short, business credit is your company’s passport to the financial world. And Coyyn.com assists you in keeping it in tip-top condition.

What is Coyyn.com?

Coyyn.com is an online platform for building business credit meant to give startups, small businesses, and entrepreneurs the tools necessary to establish a strong financial presence.

Started on the mission to democratize the access to credit-building tools, Coyyn.com utilizes technology, education, and strategic partnerships to make the credit-building process straightforward.

How Coyyn.com Assists You in Establishing Business Credit

1. Business Credit Reports and Monitoring

Coyyn.com provides instant access to your business credit reports from large agencies such as:

- Dun & Bradstreet (D&B)

- Experian Business

- Equifax Business

You can see updates, track score increases, and be notified on new inquiries or updates. This visibility enables you to identify and correct mistakes, spot growth potential, and control your financial reputation.

2. Vendor and Tradeline Reporting Guidance

Most business owners are not aware that not all vendors report to business credit bureaus. Coyyn.com offers a carefully curated list of reporting credit-building vendors and net-30 accounts that report, so every purchase you make will build your score.

They help you:

- Establish net-30 accounts with primary vendors

- Use credit responsibly

- Pay bills on time to increase credit score

This is critical to credit establishment, one of the largest credit scoring companies.

3. Business Credit Builder Program

Coyyn.com has a step-by-step Business Credit Builder Program for novices. As a solopreneur or expanding business, the program assists in:

- Getting listed with top business credit bureaus

- Applying for credit accounts in order

- Setting up your business correctly (LLC, EIN, business address, etc.)

Don’t get caught with common credit-building blunders

It’s an all-in-one package for those seeking a roadmap to credit success.

4. Business Bank Account Integration

To further improve your creditworthiness, Coyyn.com integrates with your business bank accounts to:

- Monitor cash flow

- Keep track of account balances

- Assist in preparation for lender reviews

Financial health becomes a factor in credit approvals, and Coyyn.com helps to make it easier to show fiscal responsibility.

5. Education & Expert Resources

Coyyn.com is more than a service—it’s a knowledge platform. Members receive access to:

- Credit education modules

- Business credit score analyses

- Loan readiness checklists

Case studies of successful credit-building practices

Their blog and video content also outline how credit scores work and what lenders will accept in 2025.

6. Secure Business Credit Card and Loan Matching

When your business credit meets a minimum level, Coyyn.com assists you in matching with:

- Secured and unsecured business credit cards

- Microloans

- Working capital lines

This opens you up to funding opportunities in line with your newly-established credit profile.

The site collaborates with established lenders and filters proposals according to your qualification—avoids hard credit pulls and rejection of applications.

7. Credit Coaching and Customized Strategy

Certain companies require more individualized assistance, and Coyyn.com provides that with one-on-one guidance. Their specialists assist you in:

- Establishing short-term and long-term credit objectives

- Personalizing your credit-building strategy

- Steering through business credit issues

- Plan ahead of time to seek out large loans or grants

This hands-on assistance can spell the difference between credit expansion and credit stagnation.

Real User Benefits – What Entrepreneurs Are Saying

Small business owners throughout the U.S. thank Coyyn.com for their assistance with:

Translating 0 to 80+ business credit scores within months✅

Getting $10,000+ credit lines from suppliers and banks✅

Keeping personal finances separate from business obligations✅

Approved for equipment financing and real estate loans✅

Here’s a brief testimonial:

“I began my online retail store with no credit. With Coyyn.com, in only 4 months, I established good credit, secured 3 vendor accounts, and obtained a $5,000 credit card—all without using my SSN.”

– Sarah M., eCommerce Entrepreneur

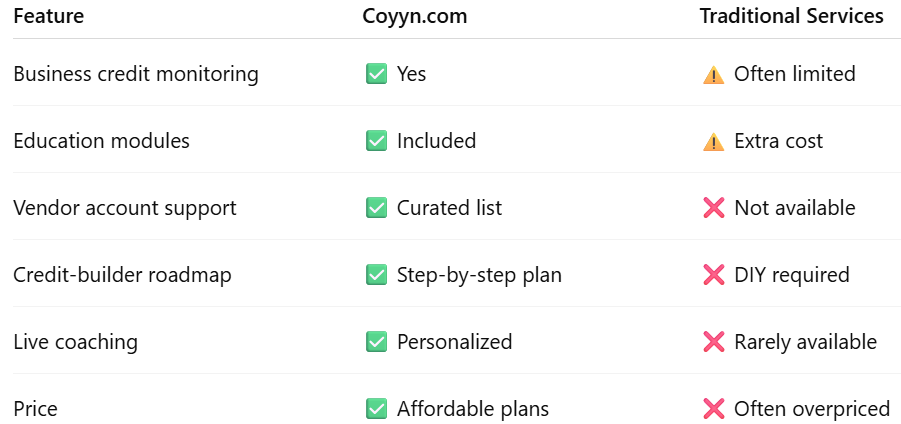

Coyyn.com vs. Traditional Credit Services

Coyyn.com provides more features at a lower cost, tailored to small business requirements.

Why Choose Coyyn.com in 2025?

Beginner-friendly platform✅

Affordable monthly plans✅

No hidden fees✅

Custom strategies for your business✅

Faster credit results than DIY methods✅

In 2025, it is no longer exclusive for big corporations to build business credit. With Coyyn.com, it is possible for even solopreneurs to access capital opportunities and scale with confidence.

Last Thoughts: Coyyn.com as a Business Credit Growth Partner

Establishing solid business credit can provide access to finance, flexibility, and freedom from money. But the journey isn’t always easy—particularly for emerging entrepreneurs. Coyyn.com is a guide that stands out as a reliable partner in this process, providing tools, information, and assistance that demystify it.

Whether you’re initially obtaining your EIN or lining up for your next funding, Coyyn.com gets you moving faster and wiser. In a credit-is-opportunity world, Coyyn.com assists you in earning your business’s voice in finance.

FAQs – Business Credit and Coyyn.com

Q1: Is it possible to establish business credit without leveraging my personal credit?

A: Yes! Coyyn.com is designed to establish credit connected to your EIN, so you can divorce business and personal credit.

Q2: How quickly can business credit be established?

A: With a solid plan and suppliers, results are achievable in 60–90 days.

Q3: Does Coyyn.com assist new businesses?

A: Yes. Coyyn.com is geared specifically towards startups and small businesses with no existing credit history.

Q4: How much does Coyyn.com cost?

A: Coyyn.com provides tiered monthly plans, with rates starting at reasonable prices—great for small companies growing rapidly.