Introduction

Investing may sound like something only the wealthy do, but that’s no longer true in 2025. Thanks to technology and financial innovation, anyone can start investing—even with just $500. Whether you’re a student, a first-time earner, or just someone ready to grow your money, this guide breaks down how to invest $500 smartly, safely, and confidently as a beginner in 2025.

Why Invest Instead of Save?

Before diving into how to invest, let’s make clear why you must invest:

Compound Growth: Investment enables your money to accelerate faster than if you just saved it.

Beating Inflation: Inflation rates are on the rise; $500 in a savings account could devalue over time.

Financial Freedom: Investment creates wealth over the long term and can generate income later.

Step 1: Define Your Goals

- Begin by posing yourself a few questions:

- Do you desire short-term or long-term returns?

- Are you planning to save for retirement, a holiday, or an emergency fund?

- How much risk are you willing to take?

- Having specific goals will direct your investment choices.

Step 2: Knowing the Risks

All investments involve some degree of risk. As a starter, it is your role to manage risk and reward. For instance:

- Stocks carry more risk but possibly higher returns.

- Savings accounts or bonds carry less risk but also less return.

- Diversification and research minimize risks.

Step 3: Investigate Your Alternatives – Top Ways to Invest $500 in 2025

1. Robo-Advisors

Best for: New investors seeking a hands-off solution.

Betterment, SoFi Invest, and Wealthfront apply algorithms to create a portfolio according to your risk tolerance.

Minimum investment: as little as $10

Fees: Typically 0.25%–0.50%

Strengths: Automated, diversified, and easy for beginners

2. Fractional Shares

Best for: Buying large-brand stocks without the necessity for a full share price.

Platforms such as Robinhood, Fidelity, and Public enable you to purchase fractions of high-priced stocks such as Amazon or Tesla for just $1.

Permits diversification with a minimal budget

Perfect for testing and educating on the market

3. Exchange-Traded Funds (ETFs)

Ideal for: New investors seeking diversification in one step.

ETFs are collections of stocks or bonds. You can purchase a part of an entire sector or market index, such as the S&P 500.

Low fees

Safer than picking individual stocks

Available on platforms like Vanguard, Schwab, or eToro

4. High-Interest Savings + CD Ladders

Best for: Very low-risk investors

If you’re cautious or saving for short-term goals, consider high-yield savings accounts or a CD ladder (certificates of deposit with staggered maturity dates).

- FDIC-insured

- No market volatility

- Low returns (around 4–5% in 2025)

5. Peer-to-Peer (P2P) Lending

Best for: Higher-risk investors looking for passive income

Apps such as LendingClub or Prosper allow you to lend to people or small business owners and collect interest.

Risk: borrower default

Returns: can be 5%–12% per year

Begin with small loans in order to diversify the risk

6. Begin an Emergency Fund (with Interest)

Ideal for: Without a safety net

Invest your $500 in a high-yield savings account or money market account. As much as it’s not exactly investing, it’s an important first step to becoming financially independent.

7. Invest in Yourself

Best for: Long-term success and skill-acquisition

Spend your $500 on:

- Online course (e.g., Udemy, Coursera)

- Investing, business, or self-help books

- New skill that can boost your earnings

- An investment in knowledge always pays the best returns.

Step 4: Select the Proper Platform

Following are trending and beginner-friendly investment platforms in 2025:

Select a platform depending on your objectives, risk tolerance, and user-friendliness.

Step 5: Diversify Your Portfolio

You can diversify even with $500:

- $200 in ETFs (low-risk)

- $150 in fractional shares in growth stocks

- $100 in a high-yield savings account

- $50 in a self-study course

Diversification safeguards you from keeping all your eggs in one basket.

Step 6: Stay Consistent

Your initial $500 is only the tip of the iceberg. True wealth depends on consistent investing. Create a regular investment of even $25/month if you can.

Compound interest increases at an accelerating rate with time and consistency.

Step 7: Keep Learning and Adapting

Read blogs, YouTube videos, listen to finance podcasts, and check your portfolio. In 2025, the financial market is rapidly changing. Keep learning and adapting.

Mistakes to Avoid

Trying to get rich quick – Most fast-money schemes are scams.

Not understanding your investments – Always know what you’re putting money into.

Ignoring fees – Some platforms charge high fees that eat into your profits.

Following hype blindly – Always do your own research (DYOR).

Bonus: How to Turn $500 into More

With discipline and smart investing, $500 can grow substantially over time.

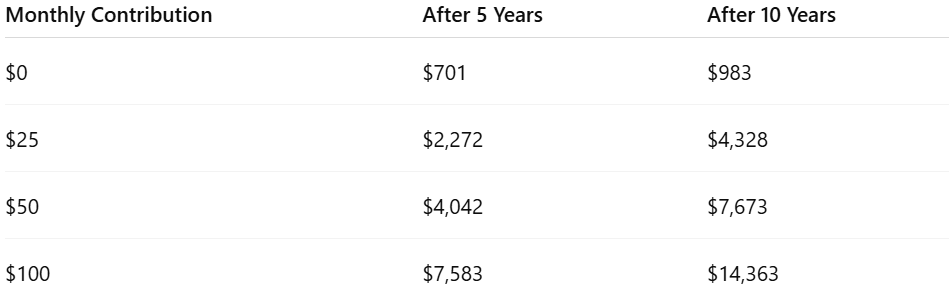

Here’s what $500 can grow to with regular contributions and a 7% average annual return:

You don’t have to be wealthy to become wealthy—you just need time, discipline, and good decisions.

Conclusion

Socking away $500 in 2025 isn’t just doable—it’s potent. With the right mind, platform, and approach, your modest beginning can become huge. Whether you’re picking ETFs, fractional shares, or investing in your talent, the trick is to begin today, remain consistent, and continue learning.

Rapid Recap: Your Beginner Investor Plan

Define your goal – Understand why you’re investing

Select your strategy – ETFs, stocks, robo-advisors, etc.

Select a platform – User-friendly and minimal fees

Begin with $500 – Divide it into groups

Continue investing every month – Let it grow gradually

Shun errors – Be knowledgeable and vigilant

Remember: The best investment is one you actually make. Begin small, envision big, and let time do the work.