Introduction

It isn’t easy to find a trustworthy loan service on the internet today. There are a lot of websites with lofty promises, but few that follow through on them. TraceLoans.com is among the select few. It combines trust, transparency, and technology to deliver a seamless lending experience. Whether you’re a lender in search of safe investments or a borrower looking for quick funding, TraceLoans.com has intelligent solutions for both.

This article discusses all you want to know about TraceLoans.com, such as its features, services, strengths, how it operates, and what makes it a market leader in the online lending industry.

What Is TraceLoans.com?

TraceLoans.com is a web-based lending platform that aims to link borrowers with lenders. It provides a simplified, safe, and convenient method for applying for and handling loans. It serves individuals and companies alike, making it adaptable for different financial purposes.

The mission of TraceLoans.com is straightforward: to accelerate the lending process, make it transparent, and trustable. It is an online platform where customers can search for loans, compare quotes, and get approved—sometimes in just a few hours.

Key Features of TraceLoaves.com

1. Easy Loan Application

One of the most appealing aspects of TraceLoans.com is its easy application procedure. Borrowers are required to share minimal personal and financial information. The website then utilizes this information to connect users with appropriate lenders.

2. Immediate Approval Options

Users usually receive immediate feedback after submitting an application. The intelligent algorithm of the platform instantly assesses the application. In case all goes well, approval may take place in minutes.

3. Inflexible Loan Types

TraceLoans.com offers a variety of loan products, including:

- Personal loans

- Business loans

- Emergency loans

- Debt consolidation loans

- Short-term and long-term loans

All this flexibility enables users to select loans that precisely fit their needs.

4. Secure Platform

Security is TraceLoans.com’s number one priority. The platform employs high-level encryption to secure user information. It also adheres to all major finance regulations, which ensures lenders and borrowers are working within a secure environment.

5. No Hidden Fees

TraceLoans.com encourages complete openness. It does not impose hidden charges or force users into an expensive loan trap. All the fees are clearly described before entering into any agreement.

How TraceLoans.com Works

Step 1: Create an Account

To begin, users need to register on the website. The process of signing up is free and is done in a flash. It asks for basic personal details and a valid email address.

Step 2: Submit a Loan Request

Once they have logged in, customers can apply for a loan. It entails the amount of the loan, repayment period, and purpose of the loan.

Step 3: Get Matched With Lenders

The website employs sophisticated algorithms to match borrowers with appropriate lenders. The system considers credit history, income level, and so forth to ensure correct matches.

Step 4: Review Offers

Borrowers receive several loan offers. They can compare terms, repayment schedules, and interest rates before making a selection.

Step 5: Get Funded

When a loan is approved, money is wired directly into the borrower’s account. In most instances, this occurs within 24 hours.

Advantages of Using TraceLoans.com

Efficient and Fast Process

TraceLoans.com makes the loan process easy. No waiting in line or paperwork. It is all done online and typically on the same day.

Competitive Interest Rates

The platform promotes competition between lenders. This results in more favorable rates for borrowers. You can shop around and select the best offer with the most reasonable terms.

Secure and Safe Transactions

High-grade encryption and strict data policies ensure all transactions on TraceLoans.com are safe. Users can be assured of entrusting their sensitive financial data to the platform.

24/7 Customer Support

The platform offers round-the-clock customer service. Whether you have a question about your loan or need help using the platform, support agents are always available.

User-Friendly Dashboard

The dashboard lets users track their loan status, repayment progress, and communication with lenders. It is easy to navigate and works smoothly on both desktop and mobile devices.

Who Can Use TraceLoans.com?

Individuals

Individuals requiring fast cash for personal spending can take advantage of the platform. It is ideal for users with medical expenses, car maintenance, education payments, or debt consolidation.

Small Business Owners

Small business owners can seek working capital or growth capital. The platform facilitates small business development through flexible financing.

Freelancers and Gig Workers

Freelance employees usually find it hard to obtain loans from banks because of the irregular income. TraceLoans.com provides a more compassionate method, considering other credit aspects.

First-Time Borrowers

Most traditional lenders shun first-time borrowers. TraceLofers.com has open arms for them. Provided the minimum requirements are fulfilled, approval is possible.

TraceLoans.com for Lenders

Not just for borrowers. TraceLoans.com also benefits individual and institutional lenders who wish to invest in loans.

Why Lend on TraceLoans.com?

- High returns on investment

- Diversified portfolio options

- Low default risk due to AI-powered vetting

- Detailed borrower profiles for risk assessment

Lenders can choose whom to fund based on verified data. This creates a safer and more profitable lending experience.

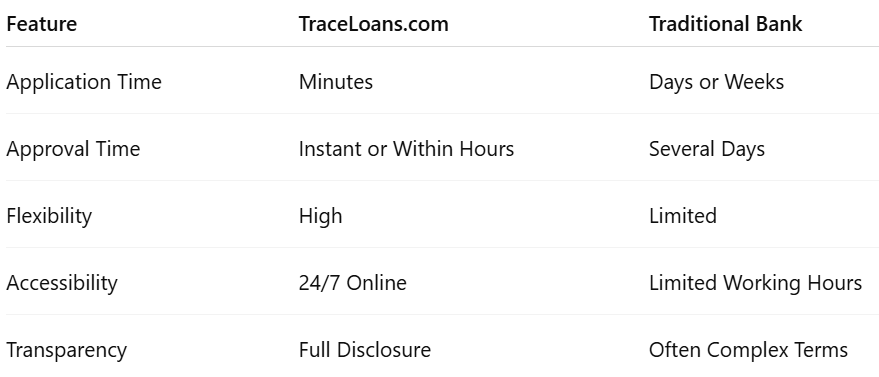

TraceLoans.com vs Traditional Lending

Clearly, TraceLoans.com offers a more modern and user-friendly alternative to traditional banking.

TraceLoans.com and Credit Scores

Concerned about your credit rating? TraceLoans.com accommodates a vast array of credit profiles.

Bad Credit? Not an issue.

Most consumers with poor or short credit history continue to qualify. Alternative scoring models are used, and actual in-life financial conduct is taken into account.

Enhance Your Rating

You can enhance your credit rating by timely repayment of your loan. TraceLoans.com is a reporting lender, which aids in creating a healthier financial record.

Actual User Reviews

“I took out a loan on TraceLoans.com and was approved in 30 minutes. The funds were in my account the same day!”

Sarah M., Florida

“As a freelancer, banks won’t give me loans. TraceLoans.com recognized my circumstances and assisted me when no one else would.”

— Jason K., California

“I invested in loans on TraceLoans.com and made good returns. It’s a wonderful passive income source.”

— Linda G., New York

Customer Support and Resources

Several options to receive assistance are available on the platform:

- Live Chat

- Email Support

- Phone Hotline

- Online Help Center

The help center features FAQs, guides, and tips on lending and borrowing. It’s ideal for newbies who wish to know more.

TraceLoans.com Mobile App

The website also features a mobile application that supports Android and iOS. The app provides users with:

- Apply for loans

- Monitor application status

- See repayment schedules

- Receive notifications

- Communicate with lenders

The application is well rated and has a smooth user experience.

Legal and Regulatory Compliance

TraceLoans.com complies with all federal and state lending regulations. It only deals with licensed lenders. This makes all the loans legal and justifiable. The website also has explicit terms of service and privacy policies.

Tips for Effective Use of TraceLoans.com

Always compare loan offers before acceptance

- Read all the terms explicitly

- Do not borrow more than you can repay

- Use loans for significant financial requirements only

- Be in contact with your lender in case of problems

Future of TraceLoans.com

The website continues to evolve. Future features might include:

- Peer-to-peer lending improvements

- Risk prediction powered by AI

- Increased credit education materials

- Expansion into international markets

TraceLoans.com will be an international leader in intelligent lending solutions with these enhancements.

Conclusion

TraceLoans.com is revolutionizing the way you borrow and lend money. With its user-friendly interface, quick approval process, and secure site, it is a reliable and efficient online lending portal. Whether you require an individual loan, business financing, or a secure investment option, TraceLoans.com has it for you.

It brings together technology, transparency, and trust to give you a financial system that works for all. If you’re ready to take control of your financial future, go to TraceLoans.com and see what your options are today.