Introduction: Redefining Real Estate in the Digital Era

The real estate industry is changing rapidly. Conventional buying and selling practices are no longer sufficient for today’s investors. Access, speed, and flexibility are what individuals demand. That’s where LessInvest.com comes into play.

LessInvest.com is a property investing platform that makes it easy for anyone to invest in property. It provides day-to-day investors with wealth-building tools without requiring big capital or specialized information. With accessibility, transparency, and intelligent technology at its core, LessInvest.com enables more people to participate in real estate than ever before.

This article delves into what LessInvest.com has to offer, how it works, and why it may be the future of real estate investing.

What Is LessInvest.com?

1. A Real Estate Investment Platform

LessInvest.com is an internet platform that allows customers to invest in real estate properties with low barriers to entry. It marries finance with technology to provide an end-to-end, digital-first experience.

You don’t have to be a landlord or purchase an entire home. Rather, you can own a portion of an investment property, participate in the profits, and build a portfolio — all in one place, online.

2. Focused on Simplicity

The mission of LessInvest.com is to simplify investing and make it more accessible. It’s real estate for the online investor, whether you’re just beginning or growing your portfolio.

How LessInvest.com Works

1. Sign Up and Verify

Begin by setting up an account. The site employs secure encryption and verification processes to safeguard your data.

2. Search for Investment Properties

Once signed up, you can browse a variety of properties:

- Residential rentals

- Commercial properties

- Multi-family properties

- New developments

- Every listing features:

- Investment summary

- Projected returns

- Risk analysis

- Location data

- Property management details

3. Choose and Invest

After you choose a property, you can invest with available cash. There are some properties that accept investments as low as $500 to $1,000. It is a completely online process.

4. Earn Returns

Your investment may earn:

- Capital appreciation in the long run

- Monthly rental income

- Share of profits if the property is sold

Earnings are disbursed through your LessInvest.com account, and you may see everything in real time.

Key Features of LessInvest.com

1. Low Minimum Investment

In contrast to conventional real estate transactions, which involve thousands of dollars up front, LessInvest.com allows people to begin with lower amounts. This is how new investors and young professionals can begin.

2. Fractional Ownership

You don’t have to purchase a whole building. With fractional investing, you own a piece with other investors. It minimizes risk and maximizes accessibility.

3. Hands-Off Investing

All the properties are professionally managed. Investors do not deal with tenants, repairs, or paperwork. You can be totally hands-off.

4. Clear Performance Tracking

The platform offers full dashboards. You can see:

- Property performance

- Earnings reports

- Market shifts

- Projected returns

This keeps investors informed and in charge.

5. Diversification Opportunities

You can invest in various properties by region, type, and strategy. Diversifying cuts risk and enhances potential returns.

Why LessInvest.com Excels

1. Designed for New-Age Investors

Investors today want digital tools, mobile access, and immediate insights. LessInvest.com provides that experience with:

- Real-time dashboards

- Automated investing options

- Notifications and updates

- Mobile-friendly access

2. Accessible to Everyone

The real estate market was once only for the rich. LessInvest.com revolutionizes that. Now, for a few hundred dollars, anyone can begin building a real estate portfolio.

3. Backed by Data and Analysis

All properties are screened by data-driven research. Risk factors, rental value, local conditions, and prices are evaluated prior to listing.

Investors have no need to investigate areas or review maintenance records — the platform does it for them.

4. Regulation Compliance

LessInvest.com engages with registered property managers and remains in compliance with U.S. securities regulations. Investors are provided with required documents and legal notices prior to each investment.

Types of Properties Available

1. Residential Properties

- Single-family houses

- Duplexes and triplexes

- Townhouses

These provide steady rent payments and long-term appreciation.

2. Commercial Real Estate

- Office buildings

- Retail plazas

- Mixed-use developments

These are higher in returns potential but might be riskier.

3. Multi-Family Units

- Apartment buildings

- Condo complexes

- They offer regular income from multiple renters.

4. Development Projects

- Ground-up builds

- Renovation flips

- Value-add properties

These have larger rewards but longer timeframes.

Returns and Earning Potential

1. Monthly Distributions

Rental income is divided among investors. Payments may occur on a monthly or quarterly basis, depending on the property.

2. Capital Gains

When a property is sold, investors can gain profits on the basis of market value appreciation.

3. Projected Range of Returns

Returns differ but average projects indicate returns between 6% and 12% each year, subject to:

Type of property

Performance of the market

Duration of investment

Past performance is not a guarantee but all estimates are founded on expert research.

Dangers of Real Estate Investing

Similar to any investment, there are dangers. LessInvest.com gives a clear look at each one of them, including:

1. Market Volatility

Property values can shift based on:

- Economic recessions

- Interest rate increases

- Local development adjustments

2. Occupancy Risk

If a rental property remains unoccupied, income can fall temporarily.

3. Regulatory Risk

Rent control or zoning law shifts can affect profits.

4. Liquidity Risk

Real estate is not an easily liquid asset. You can’t sell your shares immediately like stocks.

But LessInvest.com is currently developing secondary trading functionalities that could enable selling shares to other investors in the future.

Who Should Use LessInvest.com?

First-time investors❌

Busy professionals❌

Millennials who are building portfolios❌

Anyone who wants to diversify beyond stocks❌

Real estate enthusiasts who don’t have huge capital ❌

It’s great for individuals who want passive income without having to be landlords.

Real User Testimonials

???? “I always dreamed of investing in real estate but believed I required $50,000. LessInvest allowed me to begin with $1,000. Now I own shares in three properties.”

???? “The dashboard is straightforward. I receive updates, earnings, and projections all in one location.”

???? “At last, a platform that simplifies real estate. No gimmicks, no jargon — just intelligent investing.”

Educational Resources and Support

LessInvest.com is more than a marketplace. It also teaches users. Resources are:

- Video tutorials

- Glossary of real estate terms

- Webinars and live Q&As

- Customer support chat and email

New investors won’t feel intimidated.

Costs and Fees

1. Platform Fee

Most properties have a single upfront fee or minor percentage charged from profits. This pays for:

- Property screening

- Legal documentation

- Ongoing upkeep

Everything is fully disclosed to you before investing.

2. No Surprise Fees

There are no subscription or surprise service fees. Investors maintain complete access to their dashboard and reports.

Tax Considerations

Investors are sent tax reports (such as Form 1099-DIV) annually. Rental income and capital gains will likely be taxed. It’s a good idea to speak with a tax professional.

Some investors use Self-Directed IRAs (SDIRAs) to invest tax-deferred.

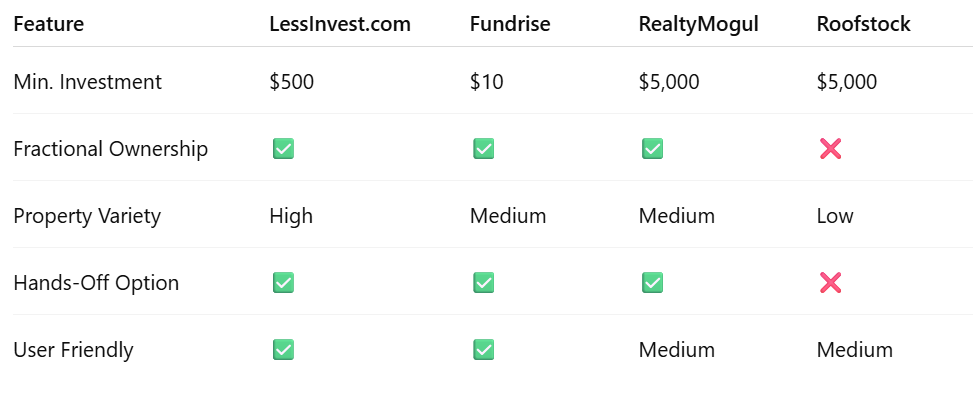

Comparing LessInvest.com to Other Platforms

LessInvest.com is ideal for low-barrier, high-transparency investing, especially for beginners.

Roadmap and Future Plans

The platform is continuously growing. Upcoming features include:

- Mobile app with real-time updates

- Secondary market for selling shares

- AI-driven property suggestions

- International investment opportunities

- Crowdfunding options for developers

These updates will make it even easier for users to grow wealth.

Conclusion: LessInvest.com Changes the Game

Real estate used to be slow, expensive, and hard to access. But LessInvest.com is rewriting the rules. It brings real estate investing into the digital world — making it fast, simple, and affordable.

Whether you’re a seasoned investor or a complete beginner, LessInvest.com offers a platform where you can build wealth, earn passive income, and take control of your financial future.

It’s not an app. It’s a new way of growing.